In the first part of this series, I opined on how the gig economy is reshaping our approach to employment in a new ‘Golden Age’ that promises unprecedented autonomy, mastery, and purpose. This second installment aims to dive deeper into the practical aspects and implications of navigating gig work, independent consulting, or freelancing.

As previously discussed, diving into the gig economy can feel liberating, but it’s not without its challenges. From managing unpredictable workloads to ensuring financial stability, gig workers face a unique set of obstacles that require strategic planning and proactive management.

I’d like to provide some seasoned advice and effective strategies to help you thrive in this often-unpredictable market.

- In a recent discussion with Brittney Tollinchi, a former staffing leader who left a Fortune 500 company to pursue personal coaching and other solopreneur work aligned with her passions, she shared valuable insights that resonate with the challenges and opportunities faced by gig workers.

- She emphasized the importance of identifying and overcoming self-imposed barriers that can quickly arise in a gig setting, noting that often there is a pathway around these obstacles if you’re proactive and creative in your approach.

- She warned against making commitments out of desperation, a common pitfall for gig workers who may feel pressured to accept less-than-ideal conditions due to fluctuating work availability.

- She also stressed the necessity of maintaining structure in gig endeavors. According to Brittney, while the gig economy offers significant freedom, this freedom can lead to problems if not tempered with the right tools and well-thought-out organizational strategies in place.

- Her perspective underscores the need for gig workers to balance the flexibility of their roles with a disciplined approach to managing their work and commitments, ensuring both productivity and personal satisfaction.

A good project management tool is essential. Here’s a list of popular tools to choose from. They vary widely in terms of features, integrations, and scalability, so do your research and know your goals before choosing.

- Free with paid premium versions available: Trello, Asana, ClickUp, Airtable, Notion

- Paid with a free trial: Monday.com, Jira, Basecamp, Smartsheet

- Paid: Microsoft Project

A Conversation with a Successful SaaS Solutions Provider

I was fortunate to score some time for an in-depth interview with the Founder and CEO of a successful SaaS start-up based out of the Denver area. He provided valuable insight into how he handled obstacles through the years as a solopreneur who scaled to small business owner. He wishes to remain anonymous due to the globally recognized clientele he serves, so I’ll call him James.

I asked James to walk me through some of his challenges after leaving the corporate world.

Acknowledging the Potential Instability and Unpredictability

The gig economy thrives on flexibility, which often comes at the cost of predictability and stability. Unlike traditional jobs, gig work can be sporadic with work volume fluctuating dramatically.

James: “This is exactly why I’ve leaned towards SaaS products, with a monthly/annual recurring subscription.”

Strategy: Diversify your gig portfolio. Similar to investment diversification, having multiple sources of gig work can mitigate the risk of income fluctuation. Also, staying abreast of market trends and adapting quickly can help you anticipate changes in demand.

Acquiring a Financial Buffer

The inconsistency in income is one of the biggest challenges of gig work.

James: “For me, having a supportive spouse was crucial. When we bought a home/car/etc. we never spent beyond what we could comfortably afford on her salary. There were absolutely wild swings in my income, and even in good years I’d reinvest what I’ve made back into the business. Eventually I traded in my $4,000 Honda Accord for a Tesla Model X and she retired.”

- Strategy: Establish a robust savings plan. Aim to save at least six months’ worth of living expenses before diving into gig work full-time. This financial cushion can help you weather periods of low work volume without compromising your lifestyle.

Health Insurance and Retirement Savings

Gig workers are typically responsible for their own health insurance and retirement savings.

James: “This was always very messy. We’d use my wife’s insurance when we could but there was a time after she retired where I was spending $1800 a month on a marketplace plan for my family, while giving employees additional stipends to do the same. We’d limit the stipend to $400 a month which had the effect of job offers only being accepted by single 20-somethings. Once we reached 5 employees everything changed, and we were able to get in with a PEO or professional employer organization. This drastically reduced our costs and allowed us to offer a full range of benefits including 401k/Health/Dental/Etc. I never found a good solution for those early years, it’s a mess where large companies have a huge advantage.”

- Strategy: Explore independent insurance brokers and professional organizations for insurance options. For retirement, consider setting up an IRA or a Solo 401(k), which are retirement accounts designed for self-employed individuals.

Researching Market Demand and Differentiation

Understanding the demand for your skills and how to set yourself apart from competitors is crucial.

James: “100% agree, find your niche and specialize. Validate your ideas with potential customers before investing time/money/effort into them. Have a plan in place for how to reach them. Always speak in terms of solutions to problems.”

The article “Nobody ever paid me for code” is written from a developer’s perspective but could apply to any profession. It discusses the necessity for professionals to shift focus from merely your skill to solving your clients’ problems. This perspective is crucial for gig workers who need to articulate how their skills provide solutions, enhancing their marketability and success in the gig economy.

- Strategy: Conduct market research to identify niches or areas where your skills can solve a specific problem. Building a personal brand through social media and professional networks can also increase visibility and attract clients.

Importance of Contracts

Understanding the basics of contracts for negotiating terms and protecting your rights as a freelancer.

James: “I’m not a big fan of over-thinking the single person LLC. An LLC is great to protect you from mistakes your employees make, but if you do the work and negligently cause your customer damage, you can still be held personally liable. I’m not saying don’t set one up, but start with a boiler-plate online offering and don’t overspend on a bunch of legal work before you even have a business. There are plenty of predatory lawyers out there that are more than happy to charge you 20k for some documents you’ll stick in Google drive and never open again. We went through three different lawyers before we found someone that we clicked with, understood our goals, and was conscious about providing value and sticking to budgets that make sense.

As far as negotiating a purchase order, it was all very scary in the beginning. We spent a few thousand to have a lawyer hold our hand through the first few and were able to come away with a boilerplate contract that still serves as our starting point today. It has evolved over time and our annual legal bills are over 50k, but we spent very little to get started. Stay focused on your core business and solving your customers’ problems and the rest will fall into place.”

This YouTube video by Mike Monteiro titled “F*** you. Pay me,” emphasizes the critical importance of contracts and the necessity of handling client relations assertively, especially in scenarios involving payment disputes.

Always ensure your contracts clearly define the scope of work, payment terms, and cancellation policies to avoid common disputes.

Understanding Your Tax Obligations

Gig workers are considered independent contractors, which means you’re responsible for your taxes.

James: “Admittedly, I’m a bit of a tax nerd, but in the beginning, we just handled this in house with QuickBooks online. Hold back 20% and pay your quarterlies and you’ll be fine. We opted to bring on a lawyer/book-keeper/accountant around year three, primarily because that was the first year we could afford it.”

- Strategy: Set aside a portion of each payment for taxes and consider using accounting software or hiring a professional to help manage your tax obligations.

Managing Your Own Schedule

Juggling multiple projects requires excellent time management skills.

James: “I kept my schedule simple and just spent 100% of my time working or sleeping. As a severely ADHD person, bouncing around between multiple projects is my superpower.”

- Strategy: Use digital tools to keep track of deadlines and commitments, such as the project management tools listed above. Establishing a routine and setting clear boundaries between work and personal time can help maintain balance.

Don’t overlook the importance of your mental health. Regular breaks, social interactions, and perhaps even joining a coworking space can mitigate feelings of isolation often associated with gig work.

Marketing Your Services

In a crowded marketplace, effectively marketing your services is key to attracting clients.

James: “I’ve known I’ve wanted to be an entrepreneur since I was eleven years old. I spent ~5 years trying and failing with different ideas and strategies. I had little to no success with online marketing and cold e-mails. The very first time I got in front of potential customers everything changed. We spent 3k for a vendor booth at an industry specific conference and all the sudden I was able to have in depth conversations with industry leaders. They absolutely loved talking about their problems and were very supportive of my proposals to solve them. I was able to continue these conversations after the conference was over. They actively gave advice/ideas/support and every single contact I made turned into an eventual sale. In person marketing and word of mouth continue to be our largest channels. None of these people would have responded to a cold email.”

- Strategy: Leverage social media platforms and networking events to showcase your work and connect with potential clients. Consider offering introductory rates or free trials to entice new clients.

Learning and Adapting

The gig economy is dynamic with new tools and platforms emerging regularly.

James: “I always joke that you have two options when starting a business; get a bunch of funding or do everything yourself. I opted for the latter and there was a time where I was the bookkeeper/accountant/help desk/401k administrator/legal aid/programmer/marketing/sales/quality assurance/dev ops/ and whatever else needed doing. I was learning on the fly.”

- Strategy: Commit to continuous learning. Online courses, webinars, and workshops can help you stay ahead of industry trends and learn new skills. I listed several resources for online education in Part I of this series.

Handling Rejection and Low Work Volume

Rejection and periods of low work volume can be disheartening.

James: “I was bad at this in the beginning, I’d say yes to each and every opportunity that crossed my desk. Many were just not worth the time and distracted attention away from more lucrative opportunities. At the same time, customers loved how responsively and cheaply we could serve them. This helped build our reputation and created the word-of-mouth marketing we rely on today. Some people say “do things that don’t scale” early on, but at the same time the business didn’t really take off until I learned to say no and focus on our core business. I don’t know, I was just afraid and desperate to fill the void. Put yourself out there and be conscious about what’s working and what’s not.”

- Strategy: Develop a thick skin and use these experiences as learning opportunities. Networking with other gig workers for support and advice can also be beneficial.

Looking Ahead

Navigating the gig economy requires more than just the flexibility to choose when and where you work. It demands a proactive approach to financial planning, a strategic marketing effort, a solid understanding of contracts, and a resilient mindset. By employing some of the strategies discussed here, I hope you can navigate the complexities of gig work with confidence and success.

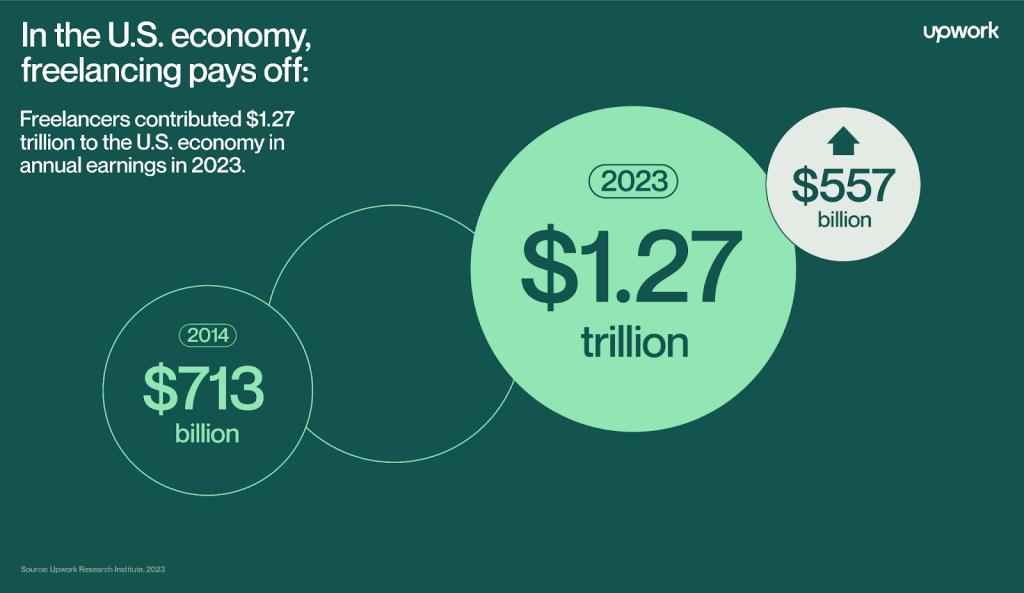

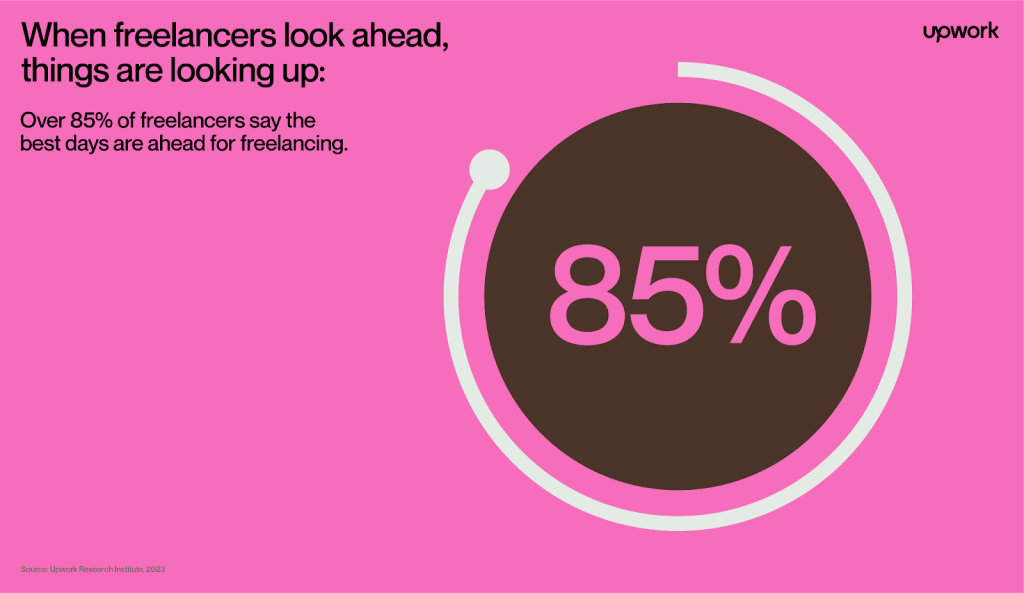

For further reading on gig economy trends, check out the detailed Freelance Forward 2023 report, which provides data on how freelancers are shaping the marketplace.

I’d love to hear from you if you’ve made the leap of faith towards a more fulfilling professional life with greater personal autonomy, mastery and purpose!