The monthly Monster Employment Index, out this morning, showed a slight decline in December. It went from 134 points in November to 130 last month.

The monthly Monster Employment Index, out this morning, showed a slight decline in December. It went from 134 points in November to 130 last month.

A decline in any jobs index, even slight, is not a good thing, considering the fragile state of the economy. However, December is typically the slowest hiring month of the year, and snowstorms in the Northeast and inclement weather elsewhere played a role.

Not to worry, says Jesse Harriott, senior vice president and chief knowledge officer at Monster Worldwide. “The Monster Employment Index has recorded a stable annual growth rate for three consecutive months, underscoring a trend of moderate labor market improvement,” he says in the press release accompanying today’s report.

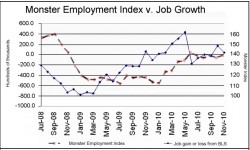

So though down in December, the Index is up 13 percent for the year. The trend is certainly consistent with other reports. The chart that accompanies this post tracks the Monster Index against the monthly job gains and losses as reported by the U.S. Bureau of Labor Statistics. Just eyeballing the trajectories, it’s obvious there is a relationship there. What’s not so obvious because of the different scales is that the Monster Index offers an early indicator of the national jobs trend.

Paying attention to reports like the Monster Index, and the monthly Bureau of Labor Statistics reports — the December jobs report will be out tomorrow — is important, Harriott says, especially for recruiters who want that proverbial seat at the big table.

I asked Harriott about this a few weeks ago, in an email exchange. What he wrote back is just what you hear preached at conferences and discussed in posts on ERE: “Top recruiters understand that staying ahead of the supply and demand trends for the competition for talent can favorably impact talent acquisition costs and an organization’s ability to compete.”

“Most recruiters with whom I speak understand the importance of staying current with labor market and overall economic trends — but I know this practice has not yet been widely adopted,” he observed.

“I would like to see the practice of monitoring economic indices become more widespread across the recruitment community in the same way monitoring those trends has become commonplace in the financial sector. In my opinion, it is a must if an organization wants to win the war for talent.”

To help recruiters understand the Monster Index, and, for that matter, other economic data, I asked Harriott to offer some guidance and to put into perspective just what the MEI is and how it is to be understood.

For openers, he said that the MEI (Monster Employment Index), begun in October 2003, “presents a snapshot of global employer online recruitment activity.”

“As a measure of online recruitment activity, the Monster Employment Index identifies underlying trends in recruitment activity as well as which occupations, industries and locations are seeing changes in demand over time. It is a leading indicator of hiring activity as it measure the intention to hire someone, whereas the monthly BLS payroll report is counting when people actually are hired.”

Q. How is the Index compiled?

A. “We review millions of job postings each month across a multitude of career websites, including Monster. We count the job advertisements by occupation, industry, and geography. We then have a methodology that adjusts for the volatility typically seen in job posting counts before we calculate the actual index value. The Index base is 100 and represents the first 12 months of the Index data collection (October 2003 — September 04). We also have the Index audited to ensure its accuracy.”

Q.The complete MEI report is fairly extensive. Walks us through the various parts of the report.

A. “Recruitment is cyclical and can fluctuate from month to month. Therefore, in the MEI report, we focus on highlighting the year-over-year changes in the index as those are the most significant and relevant. We start by showing the overall year-over-year trend by month, giving the reader a sense of whether the index trend is improving or declining. Next, we focus on the industries, occupations, and locations showing the most and least growth. Lastly, we highlight some international trends from our other Monster Employment Indices in Europe and Asia.”

In the December report, for instance, mining, quarrying, and petroleum and gas extraction are hiring aggressively. Since December last year, the index for this sector has increased about 55 percent, going from 132 to 204. At the same time, industries such as finance and insurance have barely budged, rising only one point during the year to 47.

Recruiters working in the extraction industries may sense the market is getting tighter and hiring is getting tougher. What the MEI offers is evidence of that, and a clear indication of just how significant the change is.

Q. How, then, can recruiters and HR analysts make use of the MEI and other employment data?

A. They “can leverage the MEI and other jobs data in multiple ways across the recruitment continuum. For example, it can simply be a way to stay ahead of increasing talent demand trends in areas where your company competes — and provide an early warning to the business that talent pressure is expected to increase. It is always better for an organization to enact retention strategies early rather than in reaction to increasing turnover. Monitoring labor market data should also aid in significant workforce planning efforts such as opening or closing an office, acquiring a division or building up a center of excellence. Additionally, labor market information can help in setting internal expectations regarding the time and cost to acquire specific types of talent in specific types of locations. I encourage recruitment professionals to use labor market data as a way for HR to take the lead and educate the rest of the organization. Those that do could gain considerable competitive advantage.”

reposted with permission from ERE.net