Recruiters and sourcers may find their job just a little easier this month, as more workers who have been sitting on the sidelines for months or even years, are now rejoining the labor force.

Recruiters and sourcers may find their job just a little easier this month, as more workers who have been sitting on the sidelines for months or even years, are now rejoining the labor force.

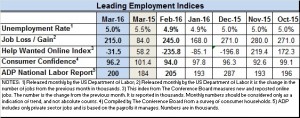

The U.S. Labor Department reported this morning that employers added 215,000 new jobs last month, marking the fifth time in the last six months that job growth topped 200,000.

This morning’s jobs report from the U.S. Labor Department came in just ahead of what economists forecast. On a seasonally adjusted basis, private sector employers added 195,000 new nonfarm jobs, with local governments accounting for the balance.

Even with January’s slow start, the U.S. is averaging 209,000 new jobs each month.

But the other news in the report suggests that the sustained job growth is convincing Americans that it’s worth going back to work. Last month, nearly 400,000 more workers joined the labor force, pushing the so-called labor force participation rate to 63%. Since September, it hit a 39-year low of 62.4%, just over 2.4 million Americans have joined the labor force.

While that slightly pushed up the unemployment rate last month to 5.0%, it’s good news of a sort for recruiters who have been struggling to fill jobs. It’s not yet possible to tell with certainty what effect the growing labor force is having, but SHRM’s LINE report says recruiting difficulty eased last month.

Noting that fewer manufacturing and service sector HR professionals reported recruiting difficulty in March, SHRM’s report said it was “first time since February 2014 that recruiting difficulty declined in both sectors in the same month.”

However, wages rose by an average of 7 cents an hour to $25.43 in March, climbing from a low of about 2% annually just a year ago to 2.3%. Economists predicting that as unemployment dropped, employers would have to raise pay in order to attract workers. Despite the increased supply of labor, wages now appear to be heading up.

Commenting to The New York Times before this morning’s jobs report, Michael Gapen, chief United States economist at Barclays said, “Wages and participation are where the rubber meets the road… We will take our cue about the overall strength of the economy based on that.”

The Labor Department report showed continued weakness in the goods producing sector, with manufacturing losing 29,000 jobs and mining cutting 12,000, mostly due to slowdowns in the oil and gas industry.

On the plus side, construction jobs increased by 37,000. Retail, healthcare, leisure and hospitality all had increases of five digits.